Get This Report on Paul B Insurance

Wiki Article

Paul B Insurance Fundamentals Explained

Table of ContentsWhat Does Paul B Insurance Mean?Get This Report about Paul B InsuranceHow Paul B Insurance can Save You Time, Stress, and Money.The Of Paul B InsuranceNot known Facts About Paul B InsuranceExamine This Report about Paul B InsuranceSome Known Factual Statements About Paul B Insurance

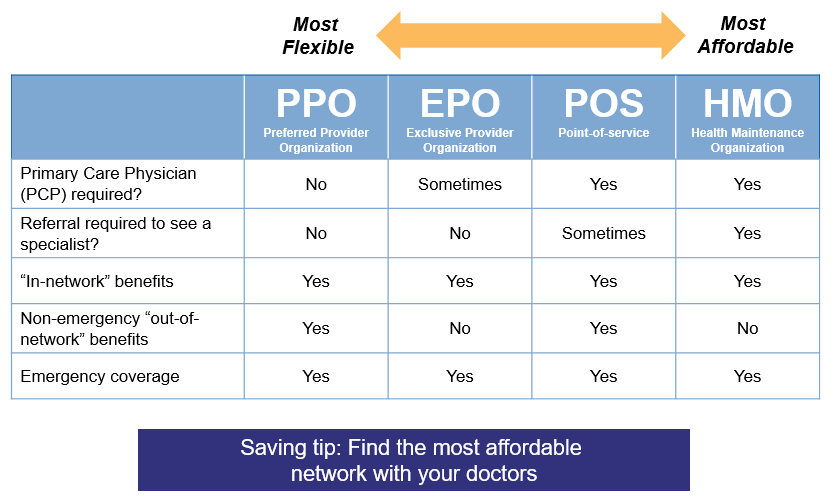

An HMO may need you to live or work in its service area to be eligible for protection. HMOs frequently provide incorporated care and emphasis on avoidance as well as health. A sort of strategy where you pay less if you use physicians, hospitals, and other healthcare carriers that belong to the plan's network.A type of health insurance plan where you pay less if you utilize suppliers in the plan's network. You can use physicians, hospitals, and suppliers beyond the network without a referral for an additional price.

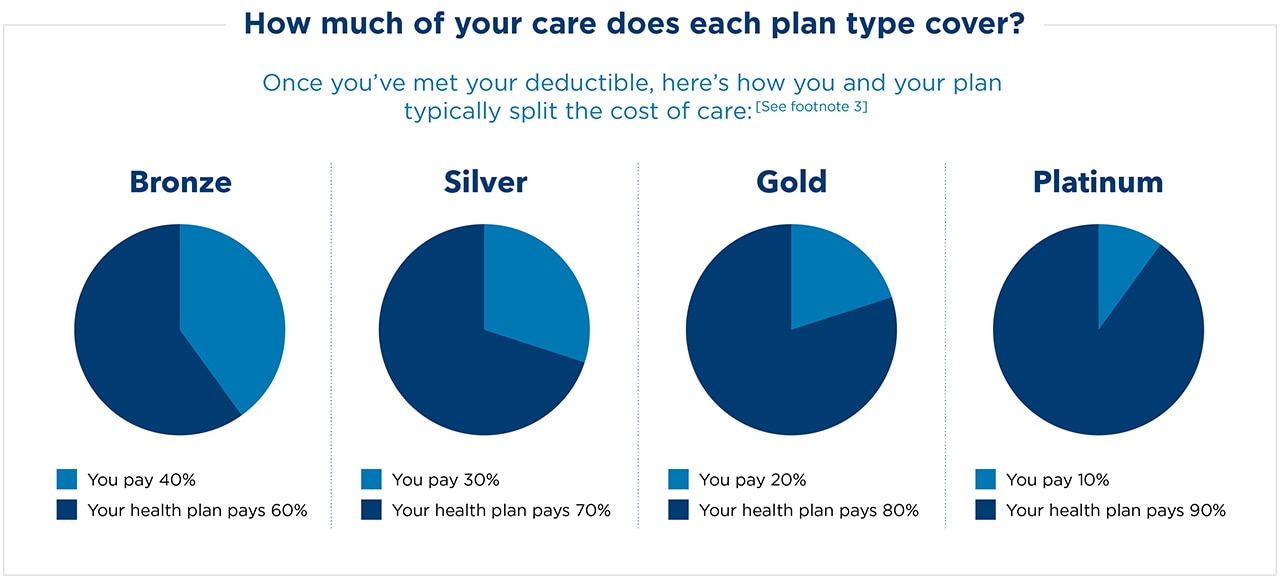

, and also platinum. Bronze plans have the least insurance coverage, and also platinum strategies have the most.

The Buzz on Paul B Insurance

Any type of in your HMO's network. If you see a physician who is not in the network, you'll might need to pay the complete costs yourself. Emergency situation services at an out-of-network healthcare facility must be covered at in-network rates, yet non-participating medical professionals that treat you in the health center can bill you. This is the price you pay monthly for insurance policy.A copay is a level fee, such as $15, that you pay when you get treatment. These charges vary according to your plan and also they are counted toward your deductible.

Paul B Insurance Things To Know Before You Buy

A copay is a flat charge, such as $15, that you pay when you obtain treatment. Coinsurance is when you pay a percent of the charges for care, as an example 20%. If your out-of-network physician bills more than others in the location do, you might have to pay the balance after your insurance policy pays its share.Lower costs than a PPO offered by the exact same insurer, Any kind of in the EPO's network; there is no coverage for out-of-network suppliers. This is the cost you pay monthly for insurance. Some EPOs may have a deductible. A copay is a level charge, such as $15, that you pay when you get treatment.

This is the expense you pay monthly for insurance. Your strategy may need you to pay the amount of an insurance deductible prior to it covers care past preventative services. You may pay a greater insurance deductible if you see an out-of-network provider. You will certainly pay either a copay, such as $15, when you get care or coinsurance, which is a percent of the costs for care.

About Paul B Insurance

We can't avoid the unforeseen from happening, yet occasionally we can protect ourselves and our family members from the worst of the monetary fallout. Four kinds of insurance policy that many economic specialists advise consist of life, wellness, automobile, as well as lasting impairment.It includes a fatality advantage as well as additionally a money value component.

2% of the American population was without insurance protection in 2021, the Centers for Illness Control (CDC) reported in its National Center for Health Stats. Even more than 60% the original source obtained their insurance coverage through an employer or in the exclusive insurance policy market while the rest were covered by government-subsidized programs including Medicare and also Medicaid, professionals' benefits programs, and the government marketplace established under the Affordable Care Act.

Indicators on Paul B Insurance You Need To Know

Investopedia/ Jake Shi Lasting disability insurance coverage sustains those who become unable to work. According to the Social Safety Management, one in four workers getting in the workforce will end up being disabled before they reach the age of retirement. While health insurance coverage pays for hospitalization as well as medical bills, you are often strained with every one of the expenses that your income had actually covered.Lots of policies pay 40% to 70% of your earnings. The price of handicap insurance is based on many variables, including age, way of living, and wellness.

Almost all states call for vehicle drivers to have car insurance coverage and the couple of that do not still hold motorists financially accountable for any type of damages or injuries they cause. Right here are your choices when purchasing vehicle insurance: Liability coverage: Pays for residential or commercial property damages and also injuries you trigger to others if you're at fault for a mishap as well as likewise covers lawsuits prices and also judgments or negotiations if you're taken legal action against since of an automobile mishap.

The Only Guide to Paul B Insurance

Employer protection is often the very best choice, yet if that is not available, obtain quotes from several providers as numerous supply discounts if you purchase greater than one kind of protection.When comparing plans, there are a few elements you'll wish to take right into consideration: network, expense and advantages. Take a look at each plan's network and also identify if your recommended companies are in-network. If your physician is not in-network with a strategy you are taking into consideration however you wish to remain to see them, you may want to take into consideration a various strategy.

Attempt to find the one that has the most benefits as well as any particular medical professionals you require. You can change health and wellness strategies if your company supplies more than one plan.

The smart Trick of Paul B Insurance That Nobody is Talking About

You will certainly have to pay the premiums yourself. Nonetheless; it may cost much less than specific medical insurance, which is insurance coverage that you acquire by yourself, and the advantages may be much better. If you get approved for Federal COBRA or Cal-COBRA, you can not be denied insurance coverage since of a medical condition.You might require this letter when you get a brand-new group health strategy or apply weblink for an individual health strategy. Specific health plans are strategies you acquire on your own, for yourself or for your family.

Some HMOs offer a more tips here POS plan. If your carrier refers you beyond the HMO network, your prices are covered. If you refer yourself outside of the HMO network, your coverage might be refuted or coinsurance needed. Fee-for-Service strategies are typically taken conventional plans. You can purchase the strategy, and afterwards you can see any type of physician at any kind of facility.

Report this wiki page